Conveyancing fees

Your property transaction is unique and since no property is exactly the same, our fees will reflect the particular requirements of your sale or purchase. For example, dealing with a listed building may, because of the added complexities, cost more than dealing with a typical freehold property. Because of this, we are not able to give you a reliable estimate of the cost of us helping you until we have details of your intended transaction. However, our fees for conveyancing start from £950 plus VAT at 20% (total £1,140), and the average fees for a house purchase that does not have unexpected complications is £1250 plus VAT at @ 20%. Properties which are leasehold, or new builds, buy-to-lets, or where gifted deposits are involved, will incur additional fees. Of course, if one of our cases does have unexpected complications, we always inform you of that immediately, and would fully discuss the potential consequences of that before any extra charges were incurred, and seek to agree the costs with you.

Our fees include electronic ID verifications and completing the Stamp Duty Land Tax return which is submitted to H M Revenue & Customs on your behalf. The cost of transferring funds between banks is charged at £48 including VAT.

In addition to our fees, there will be disbursements payable to third parties. On a purchase, the average cost of searches is £290 which includes a local authority search, environmental search, water and drainage search, development and planning search, and chancel repair policy. Final searches just before completion average £20. Stamp Duty Land Tax will be payable to HM Revenue & Customs and information regarding these can be found on the Governments website at www.tax.service.gov.uk. Land Registry fees will also be payable on a sliding scale depending on the purchase price, typically between £135 - 270.

On a sale, the typical disbursements include an up to date copy of your title of £6 per title, and if the property is leasehold, the landlord and/or the managing agents will charge a fee for providing up to date management information.

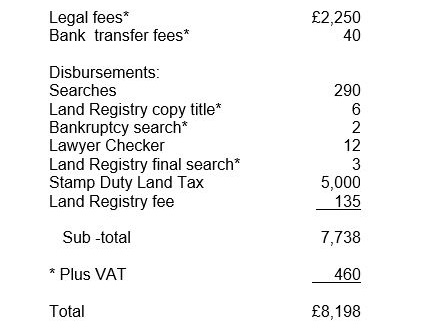

For example, an estimate of fees and disbursements for a standard sale at £300,000 and purchase at £400,000 would be as follows:

We do not pay referral fees to third parties.

Probate fees

Each probate matter is unique and we will tailor our services to your requirements. We charge a fixed hourly rate of £240 plus VAT for the time spent on your matter by our Probate Practitioner, Liz Carroll. At our initial meeting we will take instructions on the nature of the matter and we will be able to provide you with an estimate of our fees to obtain the Grant of Probate or Letters of Administration, and also to deal with the administration of the estate.

We generally find that the fees for probate matters range between £1,500 - £15,000 plus VAT plus disbursements depending on the complexities.

Typical disbursements payable include the Court fee of £155 plus 50p for each additional official copy of the Grant required. For your protection, we will also advise you as to whether Statutory Advertisements (approximately £210), Financial Assets Search (£162) and a search to establish any hope value on a property (£72) are appropriate.